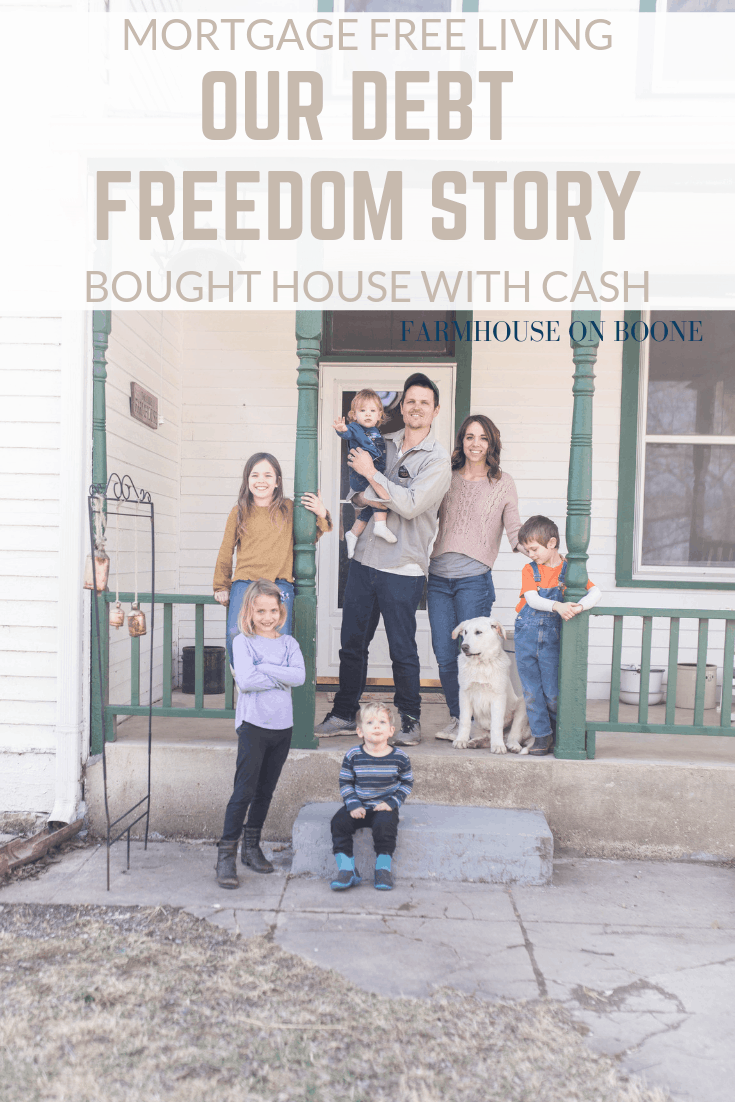

In our family, we are passionate about pursuing simplicity in our lifestyle and our finances. Today I am sharing the story of how we bought our new farmhouse with cash.

Mortgage Free Living | OUR DEBT FREEDOM STORY | Bought house with cash video

https://www.youtube.com/watch?v=hZj6FDjhbak&t=861s

Just like the process of racking up mountains of debt doesn’t happen overnight, neither does achieving debt freedom. For the last 10 years, my husband Luke, and I, have been striving toward the goal of buying our own little homestead dream place with all cash. The story took shape over time, and we didn’t know exactly what it would like in the end, but our mindset toward debt freedom always stayed the same. We craved the freedom that no debt would offer to us. We knew it was a worthwhile goal.

Buying Our First House

This story begins back when we bought our first home in 2008. The market was trending toward recession, and home prices were pretty low. In the years leading up to this time, banks were giving young couples like us loans way behind what they could afford. When the bubble burst, people were upside down in mortgages they thought they could previously afford. Determined to not let that be our fate, we kept our budget extremely low during our house buying search.

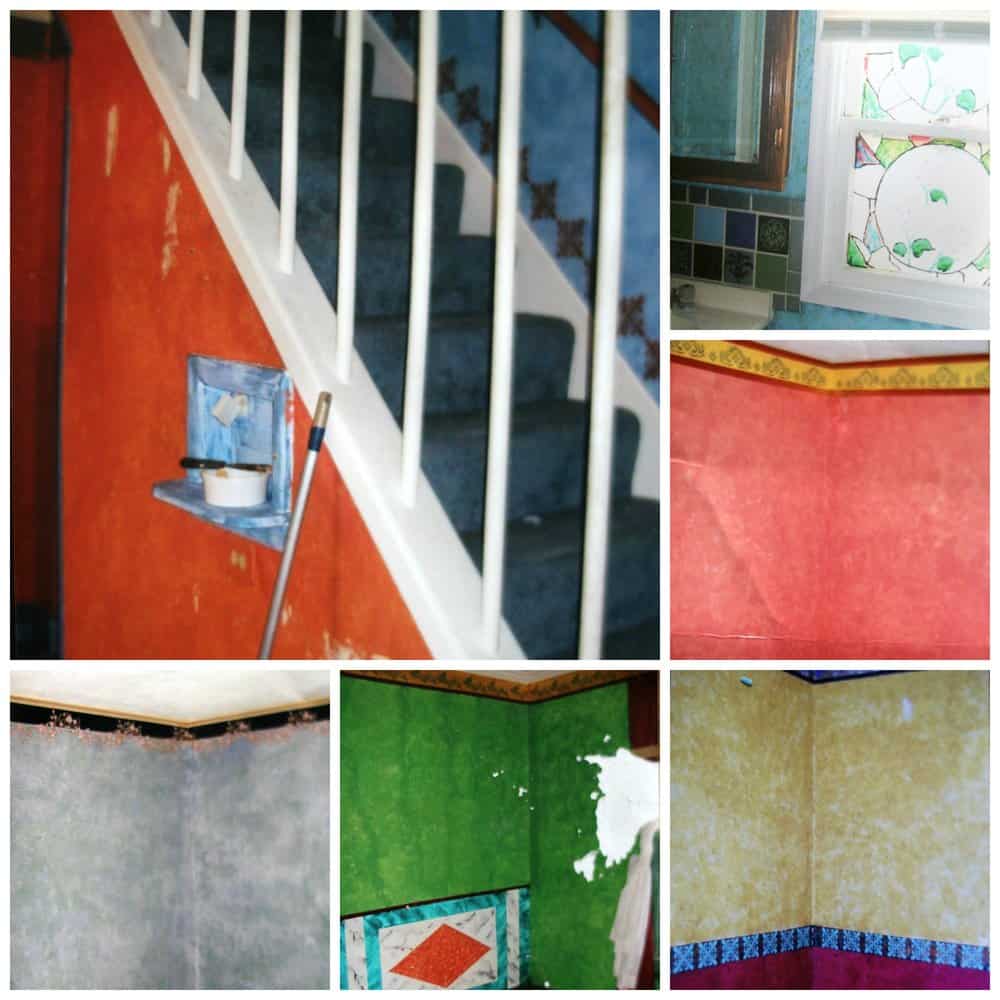

We looked at homes from $50,000 up to $100,000. Some required extensive fixing up, and some needed cosmetic updates. We probably could have been approved for a much higher loan, but we had no intentions of carrying the mortgage debt for the next 30 years. In order to pay it off quickly, it had to be cheap. We ended up settling on a 1925 Craftsmen Bungalow on one city lot. The curb appeal and interior required a TON of imagination. It scared most buyers away.

I wish I would have taken more photos, but I wasn’t a blogger back then. All I could think about doing was slapping up 10 gallons of paint to dull down the eccentricity. Plus, I was 7 months pregnant with our first child, so there was no time to waste on photo shoots.

I shared the full story of how we paid the place off in less than 5 years, and with a very modest income, HERE. But to make the long story short, we threw every extra dime we had at the house. We didn’t renovate it (except paint) until it was paid off. We took out absolutely no other debt.

I shared the full story of how we paid off our first house in less than 5 years in this post: How we Paid off our House in Less Than 5 Years

You can get all the after photos here: Our Farmhouse in Town

Ultimately we made many new improvements to our home, and held onto it until the market went back up. We owned it for over 10 years. Since it was all paid off, we were able to take that money and put it toward the purchase of our new home.

Buying our new farmhouse

We were on the hunt for a farmhouse on acreage for about 5 years before we found ours. As a farm girl myself (I grew up on 400 acres) town is a place I never intended to be long-term. We searched real estate listings, drove down every gravel road in a 50 mile radius, and told everyone we knew that we were looking for a place. We always found that we either didn’t like the land, didn’t like the house, or the place was just smack dab in the middle of nowhere. For any place to have all we wanted, it became pretty apparent that we needed to up the budget to get what we wanted.

My husband always says when we are hiring someone to do work on the house, the end result can never be all three: cheap, fast and well done. It can be cheap and well done, but not fast. It can be fast and cheap, but done poorly. I feel like the same was true for our house search. We wanted the perfect little farmhouse on acreage, but we wanted it to be in our budget. Guess what? We never found it. Because of our commitment to debt freedom, we had to wait waaaaay longer than I ever wanted to.

I was discouraged at times, and wanted to give up and get a mortgage to get our dream place. Looking back now, we would have never had the opportunities we do now if we had done that.

We were able to save up quite a bit of money while living in our paid off house all those years. With the money in savings, and the money we made from selling our improved home, we had plenty to buy our new farmhouse on 7 acres with cash.

What Debt Freedom has allowed us to do

When I was tempted to rush into debt to get what I wanted, I wasn’t thinking of the long term picture.

When I started my blog three years ago, I had a pretty huge goal. I wanted to bring Luke home from his job. I was driven by the idea of us raising our kids side by side and working exclusively from home, on our own time frame. Ultimately he did quit his job almost a year ago, and we have been living on blog income ever since.

Debt freedom gave us this opportunity. If we would have had thousands of dollars of debt, we would have been scared out of our minds to rely solely on my blogging income.

Get the full story of Luke quitting his job: This is Day One as Full Time Bloggers

Debt Freedom Mindset

Our mindset toward debt is one of “if we can’t afford it, we don’t need it!”

Now, I totally understand that unfortunate medical expenses and other life circumstances can come up, and derail the best laid financial plans. What I’m talking about is, distinguishing between a need and a want, and never buying a “want” with debt.

A new car isn’t a need. New appliance, furniture and a pretty kitchen aren’t a need.

I know they can be justifiable, but as Dave Ramsey always says, “You don’t get a pass on math.” We can do whatever we want. No one is going stop us, but no amount of justifying will change the facts that debt will take away our freedom and make our life just plain difficult.

A worthwhile pursuit

Debt freedom is difficult, and a little weird. Debt is just the standard way we do things as Americans. But, it feels soooo good when you look around and realize that everything you see you own. You don’t own any person a dime. It is beyond freeing!

Hope this story is encouraging to you to pursue the same dream.

Thanks so much for stopping by the farmhouse!

Hello Lisa,

What an inspiring post. My husband and I are able to live 95% debt free, the small amount of debt we recently incurred being the result of having to move from our home in the Santa Cruz Mountains to one in the Santa Clara Valley. Our beautiful mountain home was two stories, but with 16 steps to reach the front porch, and four more levels to get to the dining room and kitchen, the living room, to our office and upstairs.

In December of 2017 my husband required brain surgery, and afterward, while he was in rehab, I fell down a flight of stairs into a basement at the house of a friend. I was in hospital for three weeks, including one week on life support, and rehab for another three weeks. Having insurance saved us financially (and having fantastic EMTs, doctors, nurses and PTs saved us physically), and we’re immeasurably grateful for our good fortune.

I’m in complete agreement with your statement, “[I]f we can’t afford it, we don’t need it!” Another phrase I live by is, “Just because I can afford it doesn’t mean I should get it.” I try to remember to remind myself of that each time I consider a purchase, and the result is often that I don’t buy what I’m considering.

This is so awesome to hear! Never ever apologize for being smart with your money….living within your means by delaying gratification….and being a stay at home mom! You worked your butts off to make this happen! You are very blessed! We are now coasting into our retirement years….six more years! It was hard work to get to this point of being debt free. We now own two homes, newer cars, our kids have no student loan debt, no credit card debt, blessed with no medical bills and some travel money set aside! I was a stay at home mom, no new cars, no latest fashions in clothes or home and no extravagant vacations. I did this so I could stay at home for my boys. Yes it would have been easier to go back to work and let someone else raise my boys but look what I would have missed! By the way, people always thought I needed a bigger house, a newer vehicle, the latest and greatest technology and whatever else they had….but they were in debt up to their eyeballs! And today those same people that laughed at me see no retirement in site! Keep up the great work….your kids are watching your every move!

Thanks for sharing your story! Keep up the great work. You and your disciplined lifestyle is truly an inspiration! You’ve blessed me:))

Thank you so much Janet!

Thank you for this encouraging post and video. You are setting a great example! Don’t let people hassle you over not having student debt!!! Student loans are also a choice, aren’t they? I could have graduated with student debt if I had gone to the school I REALLY wanted to go to, but instead went to an in-state public school that my parents could afford, worked all through college (very part time) to pay for my non-essential living expenses like gas for my car, clothes, food, etc. Even at 18, I must have known what a burden tens of thousands of dollars would be, and I chose to avoid it. So thankful I did. I even ended up getting my PhD without any student debt, so it is totally possible! Don’t let people make you feel bad because you are “lucky” to not have student debt! We have less than one year to pay off our mortgage! So excited! Like you, we have gotten here all on our own while raising five children, saving for retirement, etc. Good work, girl!

Love this! Am experiencing a place where my husband and I are allowing God to move and dictate instead of us. I am inspired. Please express your faith more in your post! I am assuming you were praying all along the way and seeing God moving. Blessings

Great Vlog!! Wonderful encouragement for others. 👍👍

That is so awesome!! Congrats…that is def a goal of mine! Still have a while but def on my list of goals!

Yes, I was wondering about health insurance as well! I can tell you from experience, it is hell without it! My husband had heart surgery and ended up on a ventilator! The bill was devastating! If we didn’t have health insurance, we would have lost our home! Also, future planning in case one of you passed away etc. And life insurance is priceless. We need the

Employee benefits from my job! I would worry without it.

We do Christian medical sharing. It is a lot cheaper than traditional insurance, but it still covers our family.

I wish they offered that in our area.

We have life insurance and contribute to IRA’s every year. I didn’t mention these things in the video, but we do have all of them.

What does your family do about health insurance?

This is SO inspiring! We’re working on a similar finances/house trajectory and it’s really encouraging to see the 10-15 year result of really hard work. We’re a year into making a dream like this happen for us so I loved this post. Currently we’re just saving like squirrels for winter.

I’d love to see more about the little details of how you did it financially. What are things you cut? Did you go on vacations? What do you spend on Christmas for your kids while being so aggressive in savings?

And (because I have 798 questions) also, what is your long -term plan for this home? Is this where you want to retire or are you going to move on eventually and start over with a new home and property?

We never spent much on Christmas. Our kids have so many grandparents (including greats) that they never notice. We always did road trip and camping vacations. Nothing pricey. We haven’t gone anywhere in a few years, just because it is too hard with all the kids. We don’t do a grocery budget, but we cook pretty much all whole foods (very little pre-processed) and so it is just cheaper that way. I have no idea how long we will be here. People assume it is our forever home, but I have never actually said that.

We do Christian medical sharing. We would never go without insurance.

Thank you Lisa for your reply. Can you give me a link or info. where I can find out about this type health insurance- not familiar with it but love the idea. I have medicare+ supplemental but my daughter is a young single mom without insurance ( my granddtr is covered by her dad)). My daughter has health issues but feels, like so many, health ins. is out of the question. . . Please, please tell me about this. And BTW, thank God for folks like you and your beautiful family. You are lights set on a hill (YouTube Hill) that this sad, tired, world desperately needs to look at. Thanks for being faithful. God bless.

Hi Resa! You can find out more about it here: https://samaritanministries.org/

Thank you for sharing… I love the debt free story! It is so inspiring to those of us immersed in a culture that seems to run on more debt all the time. My husband and I have followed a similar path, debt free our whole marriage except for our mortgage. I know you blog is not financial, but I’m curious as to how to you juggle other savings goals, like retirement or college? I would love to throw everything at the mortgage, but I’m nervous.

We always invested in retirement. Actually I have been doing that since I was 19! We still max out our IRA contributions. We haven’t started saving for the kids college, but we will probably do that eventually too.