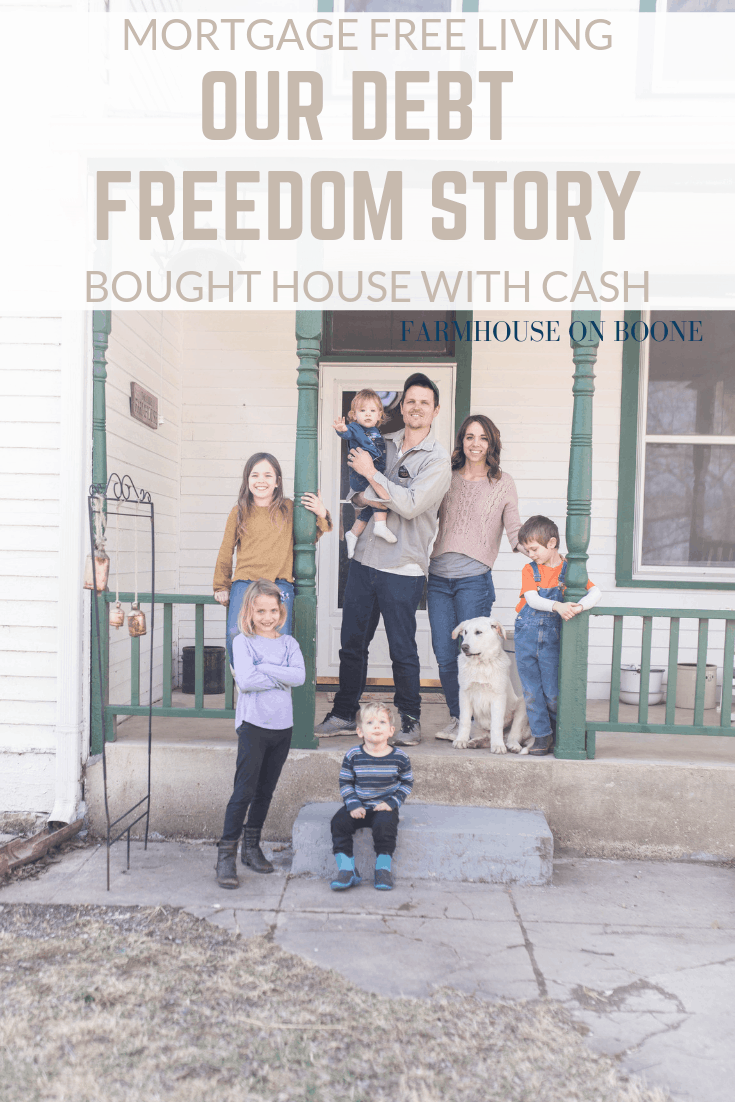

In our family, we are passionate about pursuing simplicity in our lifestyle and our finances. Today I am sharing the story of how we bought our new farmhouse with cash.

Mortgage Free Living | OUR DEBT FREEDOM STORY | Bought house with cash video

https://www.youtube.com/watch?v=hZj6FDjhbak&t=861s

Just like the process of racking up mountains of debt doesn’t happen overnight, neither does achieving debt freedom. For the last 10 years, my husband Luke, and I, have been striving toward the goal of buying our own little homestead dream place with all cash. The story took shape over time, and we didn’t know exactly what it would like in the end, but our mindset toward debt freedom always stayed the same. We craved the freedom that no debt would offer to us. We knew it was a worthwhile goal.

Buying Our First House

This story begins back when we bought our first home in 2008. The market was trending toward recession, and home prices were pretty low. In the years leading up to this time, banks were giving young couples like us loans way behind what they could afford. When the bubble burst, people were upside down in mortgages they thought they could previously afford. Determined to not let that be our fate, we kept our budget extremely low during our house buying search.

We looked at homes from $50,000 up to $100,000. Some required extensive fixing up, and some needed cosmetic updates. We probably could have been approved for a much higher loan, but we had no intentions of carrying the mortgage debt for the next 30 years. In order to pay it off quickly, it had to be cheap. We ended up settling on a 1925 Craftsmen Bungalow on one city lot. The curb appeal and interior required a TON of imagination. It scared most buyers away.

I wish I would have taken more photos, but I wasn’t a blogger back then. All I could think about doing was slapping up 10 gallons of paint to dull down the eccentricity. Plus, I was 7 months pregnant with our first child, so there was no time to waste on photo shoots.

I shared the full story of how we paid the place off in less than 5 years, and with a very modest income, HERE. But to make the long story short, we threw every extra dime we had at the house. We didn’t renovate it (except paint) until it was paid off. We took out absolutely no other debt.

I shared the full story of how we paid off our first house in less than 5 years in this post: How we Paid off our House in Less Than 5 Years

You can get all the after photos here: Our Farmhouse in Town

Ultimately we made many new improvements to our home, and held onto it until the market went back up. We owned it for over 10 years. Since it was all paid off, we were able to take that money and put it toward the purchase of our new home.

Buying our new farmhouse

We were on the hunt for a farmhouse on acreage for about 5 years before we found ours. As a farm girl myself (I grew up on 400 acres) town is a place I never intended to be long-term. We searched real estate listings, drove down every gravel road in a 50 mile radius, and told everyone we knew that we were looking for a place. We always found that we either didn’t like the land, didn’t like the house, or the place was just smack dab in the middle of nowhere. For any place to have all we wanted, it became pretty apparent that we needed to up the budget to get what we wanted.

My husband always says when we are hiring someone to do work on the house, the end result can never be all three: cheap, fast and well done. It can be cheap and well done, but not fast. It can be fast and cheap, but done poorly. I feel like the same was true for our house search. We wanted the perfect little farmhouse on acreage, but we wanted it to be in our budget. Guess what? We never found it. Because of our commitment to debt freedom, we had to wait waaaaay longer than I ever wanted to.

I was discouraged at times, and wanted to give up and get a mortgage to get our dream place. Looking back now, we would have never had the opportunities we do now if we had done that.

We were able to save up quite a bit of money while living in our paid off house all those years. With the money in savings, and the money we made from selling our improved home, we had plenty to buy our new farmhouse on 7 acres with cash.

What Debt Freedom has allowed us to do

When I was tempted to rush into debt to get what I wanted, I wasn’t thinking of the long term picture.

When I started my blog three years ago, I had a pretty huge goal. I wanted to bring Luke home from his job. I was driven by the idea of us raising our kids side by side and working exclusively from home, on our own time frame. Ultimately he did quit his job almost a year ago, and we have been living on blog income ever since.

Debt freedom gave us this opportunity. If we would have had thousands of dollars of debt, we would have been scared out of our minds to rely solely on my blogging income.

Get the full story of Luke quitting his job: This is Day One as Full Time Bloggers

Debt Freedom Mindset

Our mindset toward debt is one of “if we can’t afford it, we don’t need it!”

Now, I totally understand that unfortunate medical expenses and other life circumstances can come up, and derail the best laid financial plans. What I’m talking about is, distinguishing between a need and a want, and never buying a “want” with debt.

A new car isn’t a need. New appliance, furniture and a pretty kitchen aren’t a need.

I know they can be justifiable, but as Dave Ramsey always says, “You don’t get a pass on math.” We can do whatever we want. No one is going stop us, but no amount of justifying will change the facts that debt will take away our freedom and make our life just plain difficult.

A worthwhile pursuit

Debt freedom is difficult, and a little weird. Debt is just the standard way we do things as Americans. But, it feels soooo good when you look around and realize that everything you see you own. You don’t own any person a dime. It is beyond freeing!

Hope this story is encouraging to you to pursue the same dream.

Thanks so much for stopping by the farmhouse!

So grateful for all you share! The link to your post about how you paid off your mortgage in 5 years is broken and can’t bw found via searches. Would you be able to direct me? Thanks!

Here’s a link to the post!

Thank you so much for sharing this. This has been a HUGE encouragement. We recently bought a “fixer upper” and I have felt so embarrassed to have people over because of our awkward layout, red carpet, and hideous green counter tops with a kitchen layout that just doesn’t make sense. It’s so hard to be content with what you have when mainstream media makes people want everything. Thank you for sharing this. It was something I NEEDED to hear. ❤️

So glad it could be encouraging to you!

Oh I hear ya! Remembering to look big picture can be hard to do in those times!

Thank you Lisa

I live in Australia and I’m so tempted to buy my million dollar home but I’m sticking to our family home we have. Only got $70,000aud left to pay off. Then we can save and buy the next home with cash which is unheard of especially at our age. Thanks for inspiring me. I love working 2 days in the office and spending the rest of my time not working with my kiddos

So inspiring! Thanks for share your experience Lisa 😘

Lisa,

Thank you for sharing your debt-free advice. It was truly inspiring and I agree with it 100%. I hate debt. I watched my babysitter as a little girl always save money and clip coupons. She would go to the store with her coupons and circular ads. She told me that when she was a girl her mother told her that if you have a dime, you save a nickel and spend the other. She, her husband, and two children lived in Compton, CA close to Watts. This woman was a stay at home mom and her husband was a butcher who eventually owned his own business. By the time I got to jr. high, she desired a Mercedes Benz. Do you know what she did? She saved her money. Went up to the Downtown Los Angeles Mercedes dealership and bought her an $80,000 smokey grey Mercedes Benz debt-free! I am now in my forties, divorced, and am homeschooling 2 children. The only debt I have is my mortgage. Right now my priority is my children and making a home in the midst of brokenness. I am so glad to not have debt hanging over me. If I had debt, I would not be able to homeschool my children.